Understanding your monthly mortgage statement is akin to having a roadmap for the journey of homeownership. It doesn’t just tell you where you’ve been and where you are; it offers insights on how to navigate towards your financial goals. While many homeowners might simply glance at their statement to check the payment amount, taking the time to delve deeper into the details provided can empower you to manage your home loan more effectively. From spotting any potential errors to making informed decisions about additional payments, understanding each section of your mortgage statement is a valuable skill.

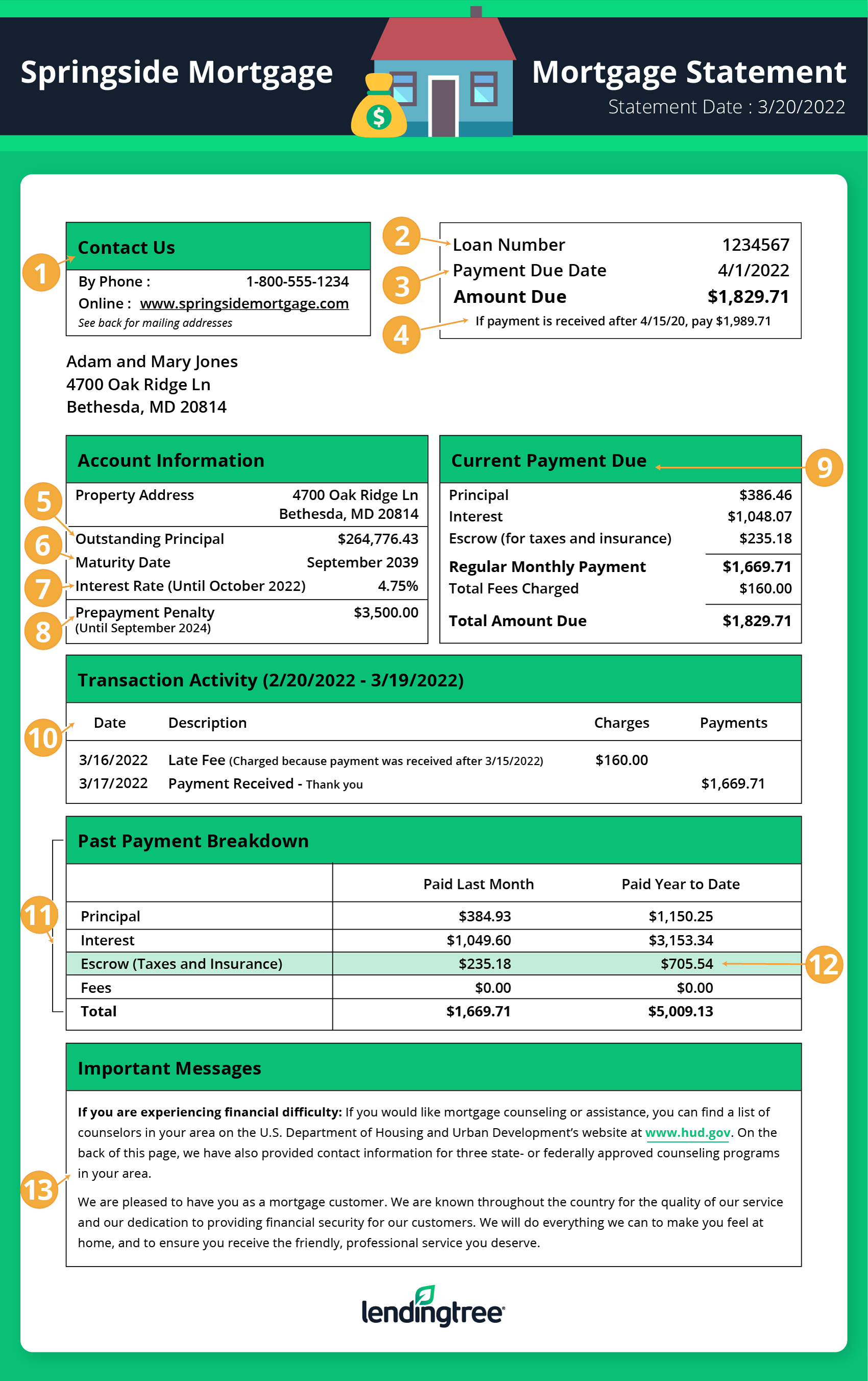

Let’s start with the basics: your mortgage statement is more than a bill. It includes contact information, such as where and how to direct your queries, and account details like your loan number, making it easier to manage your account. The statement outlines your payment due date, amount due, and if applicable, any late payment details—ensuring you’re well-informed to avoid any unnecessary fees. Additionally, the transaction activity section provides a record of your payments along with any fees or charges that have occurred, offering a transparent overview of your account activities.

Moving onto the crux of the statement, understanding the breakdown of your payment due can significantly impact your financial strategy. This includes recognizing how your payment is allocated towards the principal, interest, and if relevant, your escrow balance for taxes and insurance. Grasping the details of these allocations is crucial; early in the loan term, a larger portion of your payment is directed towards interest, but as you progress, more is applied to the principal—shifting the balance and bringing you closer to owning your home outright.

- Example of Key Sections in a Mortgage Statement Source: lendingtree.com

Additionally, the statement details such as the outstanding principal amount, interest rate, and escrow balance offer a snapshot of your loan’s current status. The outstanding principal gives you a glimpse into how much you still owe, which decreases with each payment. Your interest rate, whether fixed or adjustable, affects how much of your monthly payment goes towards interest vs. principal. The escrow balance is another vital component, especially for understanding how much is being held for property taxes and insurance. Regularly reviewing these figures can help you make informed decisions about additional principal payments or potential refinancing.

- Understanding the Amortization Schedule on Your Mortgage Statement Source: lendingtree.com

In conclusion, your mortgage statement is a treasure trove of information that, when understood properly, can play a pivotal role in your financial well-being and journey towards homeownership. By taking the time to review your statement regularly, you can ensure that you are always on top of your mortgage details, able to spot and rectify errors swiftly, and adjust your financial planning as necessary. Whether you’re a new homeowner or have been navigating the waters of homeownership for years, embracing the habit of thoroughly understanding your mortgage statement is a wise and beneficial practice.